Interview of our Senior Partner CA Sushil Kumar Khowala by Mashal News

We have almost reached the end of Q1 of FY 21-22 It is a testing time for all businesses across the world on

account of the Coronavirus. We are all working and available to support our clients.

"We also request you to stay home and be safe"

As you are aware that from 01.10.20202 TCS 206C(1H) was made effective and from 01.07.2021 TDS 194Q shall be

applicable, we have summarised both the sections below along with vis-a-vis comparison & illustrations.

TCS SECTION 206C(1H)

New TCS Section 206C(1H) is made effective from 01.10.2020 vide Finance Act, 2020 and it mandates that:

Seller– A person whose turnover exceeds Rs. 10 Crores in during the financial year immediately preceding, the financial

year in which the sale of good is carried out.

Buyer– Any person who purchase any goods, except importer of goods Central/State Government, Local Authority An

embassy, High Commission, legation, commission, consulate, and trade representation of a foreign state.

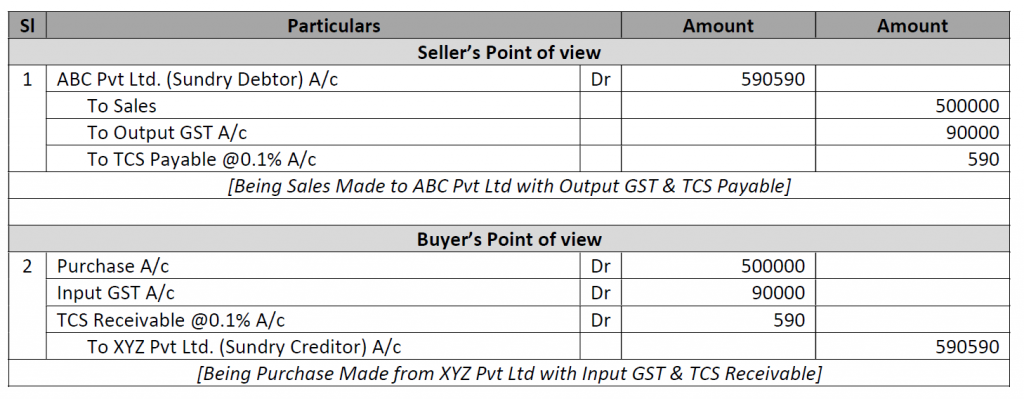

ACCOUNTING JOURNAL ENTRIES

EXPLANATION

A seller who receives any amount as consideration for sale of any goods. Then the Aggregate value of sale exceeding

50 lakh rupees in any previous year shall collect a sum equal to 0.1% of the sale consideration exceeding 50 lakh rupees from the buyer at the time of receipt as Income Tax. This section becomes operative from 1st October 2020.

IMPACT OF CREDIT NOTE/DEBIT NOTE

If sales return/credit note/debit note is before receipt of any consideration, then the impact will be included in the

amount of consideration. TCS will be applicable on the revised consideration. If the amount of consideration is already

received and TCS is collected and paid, no impact will be made at the time of passing entry for sales return/credit

note/debit note.

DUE DATE FOR RETURN

The person responsible for collecting tax shall deposit the TCS amount within 7 days from the last day of the month in

which the tax was collected. Every tax collector shall submit quarterly TCS return i.e., Form 27EQ in respect of the tax

collected by him in a particular quarter.

PRACTICAL ISSUES

FEW EXAMPLES

Case – Mr. A sales goods of Rs 6000000 to Mr. B (with PAN and Aadhar detail).

Solution – In case it is cover under this section and we must pay tax on 10 lakh (60 lakh – 50 lakh) and rate of tax is 0.1%.

Case – Mr. A sales goods of Rs 60 lakh to Mr. B (without PAN and Aadhar detail).

Solution – It is also cover under this section and taxable amount is 10 lakhs, but rate of tax is 1% because here PAN and Aadhar details are not furnished.

Case – Y sales goods to Z of Rs 60 lakh. Z is liable to deduct TDS.

Solution – It is not covered under this section because according to section 206C (1H) the provision of this subsection shall not apply if the buyer is liable to deduct tax at source under any other provision of this act has deducted such amount.

Case – Mr. X sales goods to Mr. Y and takes advance on 29.9.2020 but sale is made on or after 1.10.2020.

Solution – Receipt is before 1.10.2020, but sale is taking place after 1.10.2020, TCS should be applicable.

TDS SECTION 194Q

New TDS Section 194Q is made effective from 01.07.2021 vide Finance Act, 2021 and it mandates that:

Buyer– A person whose total sales, gross receipts or turnover from the business carried on by him exceed Rs. 10

crores during the financial year immediately preceding the financial year in which the purchase of goods is carried

out.

RATE OF TDS U/S 194Q

Buyer of all goods will be liable to deduct tax at source @ 0.1% of sale consideration, exceeding INR 50 Lakhs in a

Financial Year.

Tax to be deducted @ 5% if the seller does not provide PAN/Aadhar.

TURNOVER FOR APPLICABILITY OF SECTION 194Q

TDS obligation will be on buyers, whose gross receipts/turnover exceeds INR 10 Crores in preceding financial year.

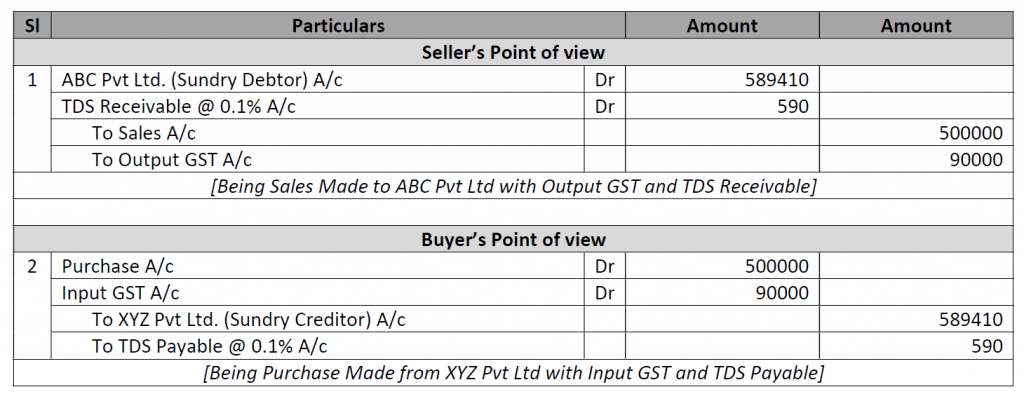

ACCOUNTING JOURNAL ENTRIES

CONDITIONS FOR APPLICABILITY OF SECTION 194Q

No requirement of TDS u/s 194Q on a transaction, if TDS is deductible under any other provision or TCS is collectible

under section 206C excluding 206C(1H) on a given transaction.

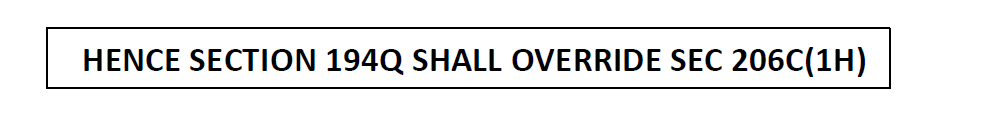

• Either TDS u/s 194Q will apply or TCS u/s 206C(1H) will apply, Both TDS u/s 194Q and TCS u/s 206C(1H) will not apply on the same transaction.

• In case of potential overlap between the two provisions TDS u/s 194Q will apply and TCS u/s 206C(1H) will not apply.

DATE OF APPLICABILITY

This provision will be applicable with effect from 1st July 2021.

Time Limit for deduction of TDS under section 194Q Tax to be deducted at the earliest of the following dates:

• Time of credit of such sum to the account of the seller or

• Time of payment.

FEW EXAMPLES

Case – Mr. C purchase goods of Rs 8000000 from Mr. D (with PAN detail).

Solution – In case it is cover under this section and we have to deduct tax on 30 lakh (80 lakh – 50 lakh) and rate of tax is 0.1%.

Case – Mr. C purchase goods of Rs 80 lakh from Mr. D (without PAN detail).

Solution – It is also cover under this section and taxable amount is 30 lakh but rate of tax is 5% because here PAN details are not furnished.

Case – Y purchase goods from G of Rs 70 lakh. G is liable to deduct TCS u/s 206C(1H).

Solution – It will be covered under section 194Q because according to Memorandum Sec 194Q shall override Sec 206C(1H). Section 206C (1H) shall not be applicable if the buyer is liable to deduct tax at source under Sec 194Q.

| BASIS OF COMPARISON | TDS 194Q | TCS 206 (1H) |

|---|---|---|

| Purpose | Tax to be Deducted | Tax to be Collected |

| Applicable to | Buyer / Purchaser | Seller |

| Date of Applicability | 01-07-2021 | 01-10-2020 |

| When Deducted or Collected | Payment or Credit, whichever is Earlier. | At the time of Receipt. |

| Advances | TDS shall be deducted on advance payments made. | TCS shall be collected on advance receipts. |

| Rate of TDS/TCS | 0.1% | 0.1% |

| Rate if PAN Not Available | 5% | 1% |

| Exceeding Limit | Turnover/Gross Receipts/Sales from the business of buyer should exceed Rs.10 cr during previous year (excluding GST) purchase of goods of aggregate value exceeding Rs.50 lakhs in any previous year (the value of goods includes GST). | Turnover/Gross Receipts/Sales from the business of seller should exceed Rs.10 cr during previous year (excluding GST) Sale consideration received exceeds Rs.50 lakhs in any previous year. (the value of goods includes GST). |

| Exceptions | To be Notified by Government | If buyer is importer of goods Central/State Government, Local Authority an Embassy, High Commission, Legation, Commission, Consulate and Trade representation of a Foreign State. |

| When to Collect / Deposit | Tax so deducted shall be deposited with government by 7th day of subsequent month. | Tax so collected shall be deposited with government by 7th day of subsequent month. |

| Quarterly Statement of Returns in | Form 26Q | Form 27EQ |

| Certificate to be Issued in | Form 16A | Form 27D |

ILLUSTRATIONS

| Sl.No. | Buyers Turnover | Sellers Turnover | Transaction Value | Section Applicable |

|---|---|---|---|---|

| 1 | 5 Cr. | 11 Cr. | 55 Lakhs | TCS – 206C(1H) |

| 2 | 15 Cr. | 7 Cr. | 58 Lakhs | TDS – 194Q |

| 3 | 12 Cr. | 13 Cr. | 54 Lakhs | TDS – 194Q |

| 4 | 7 Cr. | 5 Cr. | 58 Lakhs | NA – Turnover Limit |

| 5 | 12 Cr. | 15 Cr. | 48 Lakhs | NA – Transaction Value Limit |